2018 Energy Tax Credits: Does Insulated Siding Qualify?

2018 Energy Tax Credits: Does Insulated Siding Qualify?

Most federal energy tax credits for energy saving upgrades for residential homes expired at the end of 2016, while some were retroactively made available to purchases through December 31, 2017.

Although there are currently no federal energy tax credit programs for 2018, there are many rebates and incentives available through state and local municipalities, as well as utility companies.

There are some very reputable resources available to help determine which of these incentives your insulated siding upgrade may qualify for. Although there will likely be overlap between some of these sites, it may be worth a few minutes of extra research to make sure you are aware of all available incentives.

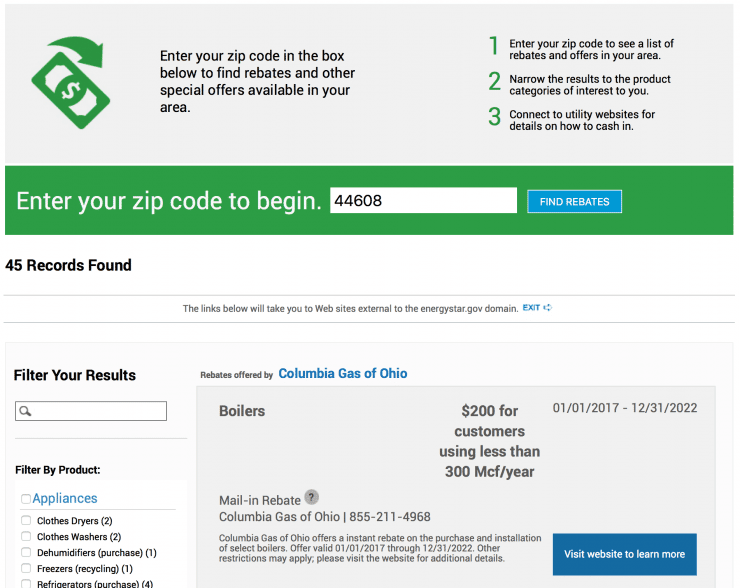

Energy Star Rebate Finder

Website: https://www.energystar.gov/rebate-finder

The Energy Star Rebate Finder is a great tool to find product rebates and other special offers available in your area for Energy Star Certified products. Simply enter your zip code for a full list of rebates in your area, which can be filtered by product, including appliances, building products, commercial food service, heating and cooling, lighting and fans, and water heaters.

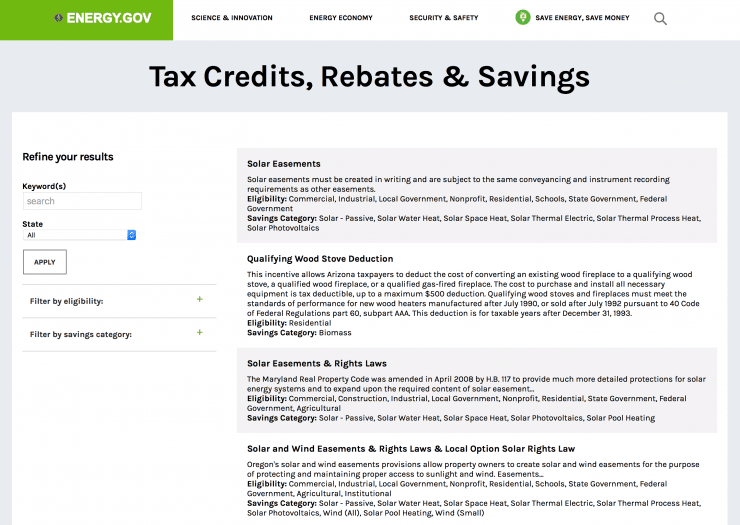

Department of Energy: Tax Credits, Rebates & Savings Finder

Website: https://www.energy.gov/savings

Similar to the Energy Star finder, simply select your state, enter any applicable keywords, and click “apply” to see the tax credits, rebates, and savings in the Department of Energy’s database. You can further filter by product (heat pumps, building insulation, etc.) and eligibility category (residential, commercial, industrial, etc.).

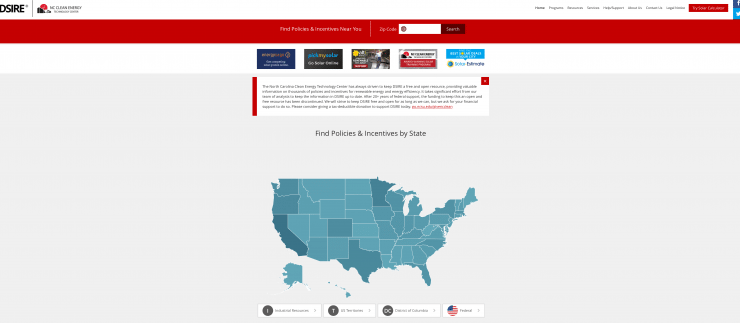

DSIREUSA.ORG

Website: http://www.dsireusa.org/

DSIREUSA.org has long been a great resource for finding information on thousands of efficiency policies and incentives across the country. Although the federal support which has helped keep the site up to date has been discontinued, the North Carolina Clean Energy Technology Center is making an effort to keep the site free and open as long as possible.

Best Practices for Claiming Your Tax Credit

Depending on the tax credit provided by your state, municipality, or utility company, you will want to carefully follow their instructions for claiming your energy tax credit for insulation. Consider also taking the following steps:

- Request an invoice demonstrating the cost breakout of the insulation component from your contractor. The cost tpyically must exclude the cost of onsite preparation, assembly, original installation labor, siding or sales tax, although it’s a good idea to check. This will help verify the true value of the insulation upgrade, separate from the other products that might be used on your project.

- Download any official certificates from the manufacturer. This will help verify the energy performance of the product and that it qualifies for the credit you’re applying for.

- Retain these documents for your records. You may not be required to provide this documentation to the IRS when filing for your tax credit, but you will be required to present it if audited.

When investing in a home improvement project such as insulated siding, it is great to not only get the energy savings year after year, but also put a few bucks back in your pocket at tax time. If you still have questions about possible tax credits, incentives, and other rebates for energy saving upgrades such as insulated siding, contact us for more information.

Other Related Topics